Supply And Demand

Depending on their geographic focus, different groups act as supply and demand within the network. Real estate owners and companies are both in supply and demand. Real estate brokers and agents are both supply and demand. Municipalities are both supply and demand. Low-altitude airspace infrastructure providers building drone decks and flying taxi vertiports are supply and demand as they expand their operations. Individual homeowners are mainly on the supply side.

DeFi projects that offer lending for air rights assets and per-minute insurance to commercial drone companies compound the demand. Further financialization using DeFi projects will be built on top of the SkyTrade protocol.

Cellular network operators and solar infrastructure demand air rights. Billboard companies require visibility to increase the number of eyeballs on their property and demand air rights. Commercial drone operators and speculators demand air rights.

| Supply | Demand | |

|---|---|---|

| Individual Home Owners | ✅ | |

| Large Real Estate Companies | ✅ | ✅ |

| Real Estate Brokers & Agents | ✅ | ✅ |

| Municipalities | ✅ | ✅ |

| Low-Altitude Infrastructure Providers | ✅ | ✅ |

| Commercial Drone Operators | ✅ | |

| Traders | ✅ | |

| DeFi Projects | ✅ | |

| Data Insights | ✅ | |

| Cellular Networks | ✅ | |

| Billboards | ✅ |

Real Estate

Demand for air rights has surged recently, with various examples highlighting the market's strength. Citadel, for instance, paid $164 million for the air rights above St. Patrick's Cathedral in New York City, while Madison Square Garden's air rights are valued at $450 million. Grand Central Terminal's air rights sale to JP Morgan for $240 million illustrates the demand. Condo buildings pay millions to protect their views, such as $11 million for a view of the Empire State Building.

Governments have recognized the potential of air rights as an asset class, with San Francisco selling City Hall air rights for $45 million. Utah passed legislation to lease their air rights, encouraging homeowners to monetize theirs. London has increased the utility of air rights, and NYC recently passed the 'City of Yes', which enables air rights owners even more opportunity to trade their air rights.

Telecom Assets

Telecom assets such as towers with antennas sit within the 3D airspace, and the air rights owners control their use. In many cases, these assets take the form of leases. This global market is worth over $100B They yield cashflows between 6% and 16% per annum and generally have inflation-linked escalators, making them highly attractive. However, they are typically swept up by private equity funds and locked in investment portfolios, restricting access for most investors.

We have a pipeline of these assets, which we are bringing on chain in partnership with a multi-decade-old telecommunications infrastructure operator. They see the opportunity to bring these assets to new purchasers, reducing friction and costs. SkyTrade fractionalizes these assets, and the yield-bearing tokens can be purchased from investors on our platform.

The current pool, which will open in Q2.25, includes $8M of income-producing assets, which gives a gross yield (pre-fees) of 10%, a 6% per annum escalator to hedge inflation, and a default rate of less than 1%.

We make these assets available to purchase through stablecoins, allowing investors with stablecoins to receive strong returns with little risk. These assets can be leveraged through our partners for exponential returns.

Individual

Individual homeowners can self-serve and register their air rights on the platform. Once we perform several checks that increase the value of the air rights parcel, they are tokenized and available on the marketplace. This group offers air rights to the market on the supply side for trade and transit.

Corporate

The B2B corporate real estate category includes large-scale real estate managers, owners, and developers. We take any data format from these groups and register the air rights onto the marketplace; these are then tokenized. We have built relationships with large real estate companies who are on both the supply and demand sides of the marketplace.

Municipalities

Advanced contract negotiations with a State-level transportation department in the United States to monetize the state's low-altitude airspace are being concluded. They will deliver significant revenue to the protocol. Additionally, there is a pipeline of five cities in the United States where SkyTrade will power the air rights access and payments for these cities' drone and electric Vertical Take-off and Landing vehicles (eVTOL) infrastructure. Private air rights in these cities are also being onboarded; through the SkyTrade rewards and incentive program, community members will benefit from referring air rights owners in these locations to the network.

Drone Operators

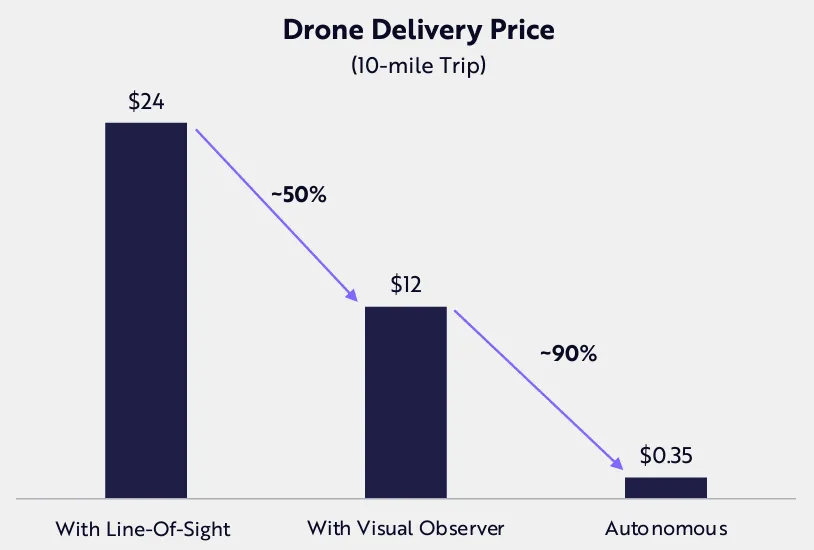

SkyTrade's consumer-facing opportunity enables air rights rentals for drone deliveries, allowing them to fly below the required 400 feet and into private airspace. Drone deliveries will reduce traditional delivery costs by ~90% over time. ARK forecasts drone deliveries to reach $450 billion by 2030.

Walmart is a significant player in drone delivery, having conducted 2,000,000 flights. They are covering 75% of Dallas Fort-Worth. Their goal is to deliver to 90% of the US population. Amazon is also investing in drone delivery. Wing, owned by Google has done over 400,000 commercial drone flights and needs legal access to low-altitude airspace.

With the recent spate of Walmart drone shootings by private air rights owners, the demand for legal routes and permission to be in the airspace is very high. Legally, all drones flying over real estate are trespassing if they are not permitted to be there.

Air rights will become the predominant means of allotting 3D geographic locations for development in new states. The SkyTrade protocol will be made available to these network states to help them grow.